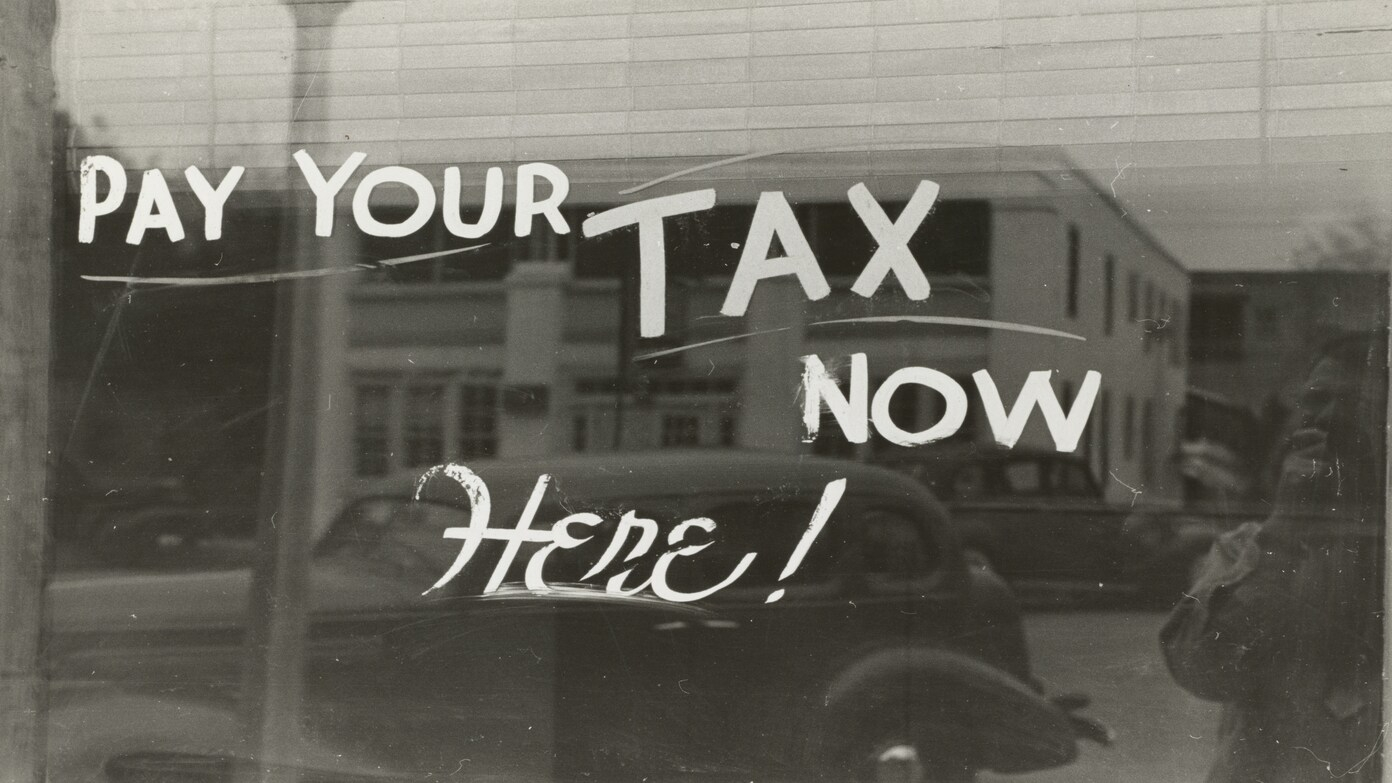

Tax season is here, and the IRS expects over 140 million tax returns to be filed by the April 15 deadline. Many people miss out on valuable tax credits and deductions that could lower their tax bill or even result in a refund. Here’s a simple guide to some often-overlooked tax breaks you might qualify for.

Overlooked tax credits and deductions

1. Charitable Donations Deduction

- If you itemize deductions, you can deduct donations made to IRS-recognized charities.

- This includes cash, property (like furniture or art), and even mileage or gas costs for volunteer work.

- Keep receipts and records of your donations.

- For donations worth $250 or more, you’ll need additional documentation.

Read now: IRS2Go: where to download and how the IRS app works to file taxes online and get refunds faster.

2. Student Loan Interest Deduction

- You can deduct up to $2,500 in student loan interest paid in 2024.

- This applies to loans for yourself, your spouse, or a dependent.

- You don’t need to itemize to claim this deduction.

- If someone else (like a parent) pays your student loan interest, you can still deduct it if you’re no longer a dependent.

3. Retirement Savings Contribution Credit (Saver’s Credit)

- If you contribute to a retirement account like an IRA or 401(k), you might qualify for this credit.

- The credit is worth up to $1,000 ($2,000 for married couples).

Your income must be below certain limits to qualify:

- $76,500 for joint filers

- $57,375 for head of household

- $38,250 for others

4. Gambling Losses Deduction

- If you win money from gambling (like the lottery or casinos), you can deduct your losses.

- You must itemize deductions, and your losses can’t exceed your winnings.

5. Tax Credit for Other Dependents

- This credit is worth up to $500 for dependents who don’t qualify for the Child Tax Credit.

- It applies to older children, adult dependents, or relatives you support.

Read more: How to create an IRS account and the advantages of doing so – Follow the step-by-step guide to do it.

6. Earned Income Tax Credit (EITC)

- This is a refundable credit for low- to moderate-income workers.

- The amount depends on your income, filing status, and family size.

- For example, a single filer earning up to $25,551 could get a maximum credit of $632.

7. Jury Pay Deduction

- If your employer requires you to surrender your jury pay, you can deduct that amount.

- This applies even if you take the standard deduction.

8. Child and Dependent Care Credit

- This credit helps cover childcare costs so you can work or look for work.

- It applies to daycare, preschool, summer camp, and even payments to babysitters (except close relatives).

- The credit is worth 20% to 35% of up to $3,000 in expenses ($6,000 for two dependents).

9. State and Local Tax (SALT) Deduction

- If you itemize, you can deduct up to $10,000 in state and local taxes.

- This includes income taxes, sales taxes, and property taxes.

10. Mortgage Points Deduction

- Points paid to lower your mortgage interest rate are tax-deductible.

- You’ll receive a Form 1098 from your lender showing the amount you can deduct.

11. Moving Expenses for Military Members

- Only active-duty military members can deduct moving expenses.

- This applies to moves due to permanent change of station orders.

Tips for Maximizing Your Tax Savings

- Itemize vs. Standard Deduction: Compare your itemized deductions to the standard deduction to see which saves you more.

- Keep Records: Save receipts, bills, and documentation for all deductions and credits.

- Check Eligibility: Use IRS tools or consult a tax professional to confirm which credits and deductions you qualify for.

By taking advantage of these tax breaks, you could save money and make tax season a little less stressful. Don’t wait—file your return before the April 15 deadline!